Cryptocurrency certainly has some benefits for investors. According to investors, cryptocurrency has the power of changing the monetary scenario of the world soon. This is the reason most people are interested in investing in Bitcoin and other cryptocurrencies. Before stepping into the investing part, you need to know about the tax obligations related to the investment. Here is everything you need to know about tax obligations related to cryptocurrencies.

Legalities regarding cryptocurrencies

The legality of cryptocurrencies in India: cryptocurrencies were introduced in India back in 2009. But in 2018 Reserve Bank of India passed a statement through which they asked all the banks not to deal in cryptocurrency. Banks stopped circulating digital money till 2020. In March 2020, the Supreme court published a verdict where they nullified the decision taken by RBI. The Supreme Court permitted all nationalized banks to deal in digital money as per their choice. In 2021, the government published the cryptocurrency and regulation of the Official digital currency Bill. According to this bill, Bitcoin and other cryptocurrencies are permitted to be regulated across India for paying taxes and bills.

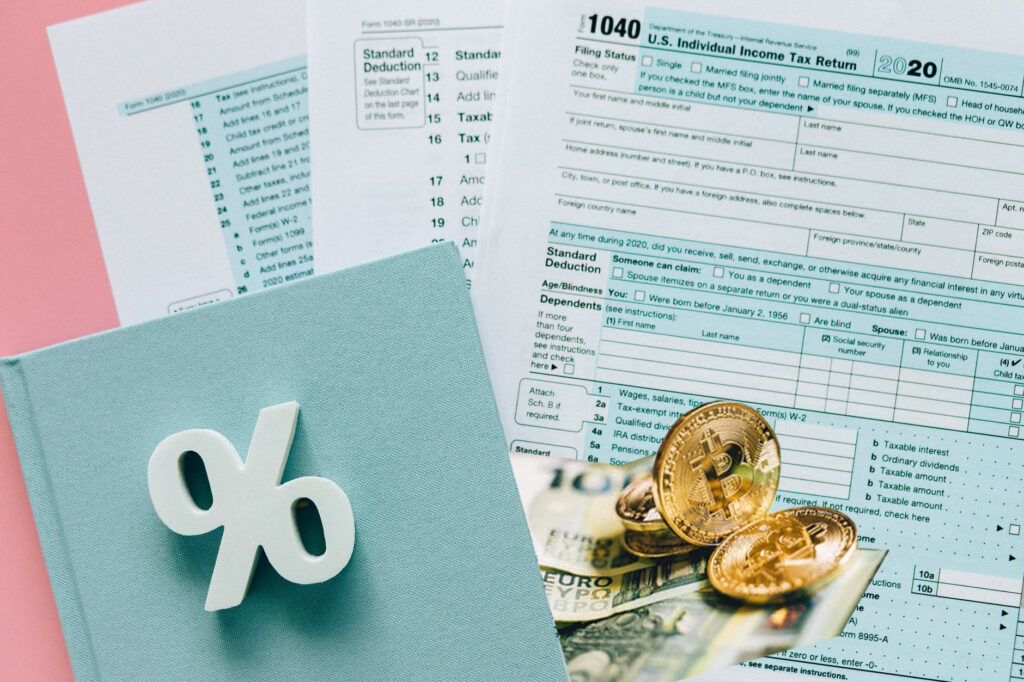

Tax implications regarding cryptocurrencies

Generally, RBI grants legal tender status to money in India. In the case of cryptocurrencies, RBI has not finalized any status as of now. According to the RBI, there are no proper tax-related rules available for cryptocurrencies as of now. This is what is making the whole situation worse. At this juncture, there is no proper clarification given by the income tax department. Hence, the taxation levied on cryptocurrencies is not clear to the investors. But the expert investors are positive about the future of Bitcoin. According to the experts, soon, there will be tax specifications announced about cryptocurrencies. The Crypto transactions will be taxed under the very famous Income Tax Act 1961. It can also be taxed under the Central Goods and Services Tax. The department has not decided about the type of tax levied on digital money. But soon, the government will declare everything in detail.

Considering earning from different sources

Here we are considering earning from different sources like mining cryptocurrency. Lots of people earn a lot of money in this procedure. Here are two types of results that we might get out of it.

Generating Crypto through mining:

You can generate cryptocurrency through mining. The taxation department can place cryptocurrency under two forms; Capital gains or income from other sources. Cryptocurrency is a self-generated asset, and hence, there are lots of complications around its taxation procedure. Nothing is clear as of now. Normally the digital money earned through mining should be considered as income from other sources. But Section 55 of the Income Tax Act says something different. This act is associated with the cost of acquisition and improvement, and this act does not understand digital money mining.

Receiving as a gift:

If digital money is received as a gift, it will be taxed as per the norms. Generally, gifts are associated with income from other sources. In such cases, gifts are taxed as per individual slab rates. If you receive digital money worth INR50000 or more, the entire money will be taxable.

Conclusion: Recently, it is also heard that soon, cryptocurrencies will be taxed under GST at an 18% rate. No matter what the present taxation scenario is, cryptocurrency is still a lucrative way of quickly earning a lot of money. So, start investing today, and soon you will see the amazing result.